One of my favorite posts to write!! My top credit card recommendations for beginners! I have loved getting to educate my friends on my favorite credit cards to get into the travel hacking game. These are cards that are universal, have low annual fees, and are easy to use.

1. Chase Sapphire Preferred

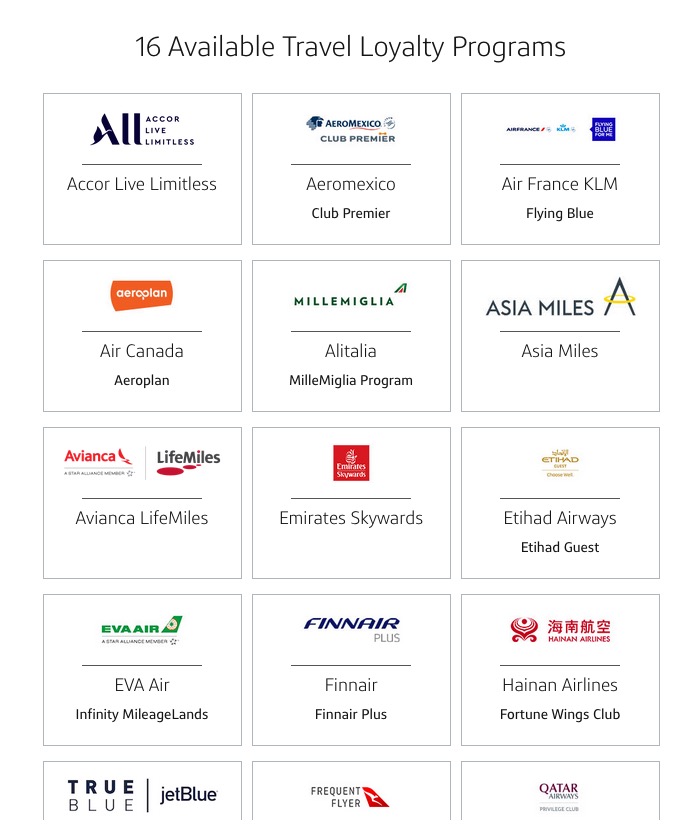

If I could recommend any card for a beginner, it would be this one! I love Chase points because they transfer to Hyatt, United, Southwest, Virgin Atlantic, and Air France/KLM plus many more.

I always advise people to get Chase credit cards first because Chase has a 5/24 rule. Meaning, you will not be approved for any Chase cards if you have opened 5 or more credit cards in the last 24 months.

I like this card because it has a low annual fee of $95 that can be offset by many perks:

- 3x points on dining

- 3x points on select streaming services

- 3x points on online groceries/meal subscriptions

- 2x points on travel (this category is very generous! Think paying for parking earns you points generous!!)

- 5x points on travel booked through the Chase portal

- $50 hotel credit when you book a hotel through the Chase portal

These points earning categories are ones that people often spend a decent amount of money on (think restaurants), so it’s nice to have a card that earns 3x the points to make your dollars work a little harder for you. The sign up bonus for this card is normally 60,000 points when you spend $4k in 3 months. I find that this card is my most swiped in my wallet because anytime I eat out, I use this card. I also use this card for all my subscriptions and random travel-related expenses!

Have I officially convinced you to give this card a try?? If I have, please use my referral link to apply! It comes at no cost to you but helps support me and my blog 🙂

https://www.referyourchasecard.com/19l/UFANE9R5K6

2. Capital One Venture

I like this card because it has a very simple points earning strategy —earn 2x points on all your spending. As a beginner, this is great because it is a “no think” card. You don’t have to worry about what categories earn you more points, because every time you swipe, you will get an automatic 2x points!

This is another card that has a low annual fee of $95 per year that is easily offset by many perks:

- 2x points on everything

- $100 credit for precheck or global entry (precheck is a lifesaver!!)

- Eraser – more below.

The sign on bonus for this card is usually 75,000 points if you spend $4k in the first 3 months! While I do love this card, I prefer the Chase card for a beginner because Capital One only transfers to US-based airline JetBlue, which operates flights mainly out of the east coast.

The eraser! What makes this card great for a beginner is the ability to “erase” your travel purchases at a rate of 1 cent per point. For example, say I buy a flight on Delta airlines for $400. With that lovely 75,000 point sign on bonus I earned, I use 40,000 of them to erase that purchase on my credit card statement. Delta is a not a partner with Capital One, but with the magic eraser feature, you can erase any travel purchase on your statement!

Capital One has other great transfer partners to international airlines, but when you are just entering the travel hacking game, that is a hard concept to master.

My Referral Link:

https://i.capitalone.com/GRG7Ni0cH

3. Bilt Mastercard

If you pay rent, this is a must have card in your wallet. Bilt is the first and only credit card that lets you pay your rent with no extra charges for using a credit card! I personally use this card to pay my rent and can vouch that it works! How Bilt does this is they give you a routing number and bank account number that are attached to your credit card. You then input that information into your rent portal, so from the landlord’s end, it looks like you are paying with a bank account. However, the funds actually pull from your credit card and you earn 1x the points! Bilt also has a feature that you can pay by check as well, but I prefer the online portal route.

Rent is my largest expense every month, so it is nice to know that I am earning 1,000 plus points each month! Bilt also has a fun rent day challenge, where at the first of the month you are able to compete in various challenges to earn free points. Also, Bilt has special points transfers or points earning categories for the first day of the month only.

In the past, some of the specials were 5x points on tickets to sporting event/concerts, 75% transfer bonus to Aeroplan Air Canada (1 Bilt points = 1.75 Aeroplan points!). These transfer bonuses are insane and unheard of!

On the first of the month you also earn:

- 6x points on dining

- 4x points on travel

- 2x points on everything else!

For the rest of the month you earn:

- 3x points on dining

- 2x points on travel

- 1x points on rent/everything else

Use your points to pay for your rent, or you can use your points towards a downpayment on a house! You heard that right! Bilt is helping you earn equity towards your future home!

This card has no annual fee! However, there is no sign up bonus for this card:/ Bilt can get away with no sign on bonus since it is the only card that lets you pay your rent with no extra charge!

Bilt also has amazing transfer partners like American Airlines, Hyatt, Hawaiian Airlines, Marriott, and British Airways! Bilt is the only transferable card program to transfer to American so if you are loyal to American Airlines it is a win-win!

Here is my referral link:

4. Amex Green Card

AMEX has a wonderful array of higher end credit cards that are talked about a lot, but I think the AMEX green card is underrated! AMEX has great transfer partners like Delta, Virgin Atlantic, Flying Blue, Aeroplan, British Airways, Jet Blue and more!

I love having AMEX points because I often fly Delta, which is a transfer partner with AMEX, but I find the Delta AMEX credit cards don’t earn me nearly as many points compared to earning AMEX points and then transferring them to Delta.

This card has a higher annual fee of $150, BUT you earn:

- 3x points at restaurants

- 3x points on streaming

- 3x points on travel, public transportation, and rideshares

- $189 annual clear credit

If you use Clear, this card is a no brainer! The Clear credit alone offsets the annual fee each year.

This card comes with a sign up offer of 40,000 points if you spend $3,000 in 6 months, which is very reasonable! Overall, I think this card doesn’t get enough hype. It has higher point multipliers, great transfer partners, and you get Clear for free each year!

Sign me up! (This link will take you to the AMEX Platinum card, but from the website you can then select the Green card:)

https://americanexpress.com/en-us/referral/TARYNDWu0X?XL=MIMNS

5. Citi Premier Card

This is another under-hyped card! I personally don’t have this card, but it has a low annual fee, lots of different points earning categories, which makes it the perfect card to get into travel hacking. Citi transfers to JetBlue, Flying Blue, Emirates, Turkish Airlines, and Virgin Atlantic. Personally, these transfer partners aren’t my favorite, but they still provide a lot of value!

This card earns:

- 3x points on restaurants, supermarkets, and gas stations

- 3x points on travel

- 1x points on everything else

The offer is 60,000 points after you spend $4,000 in 3 months!

Let me know if you have any of these cards and what you think of them! Are there any other good beginner credit cards that I missed?